BOOST Your Super: Invest In Property Now & Secure an Early Retirement with Over DOUBLE the Savings!

- Start With A Super Balance of Just $200,000 (Single or Combined)

- No Out Of Pocket Expenses

- No Extra Savings Needed Outside Of Your Super!

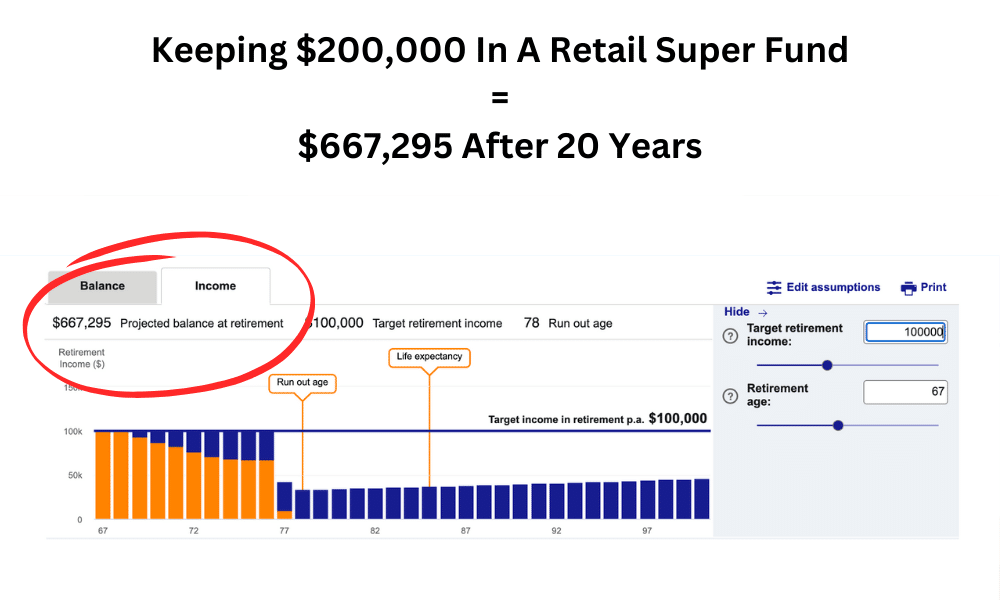

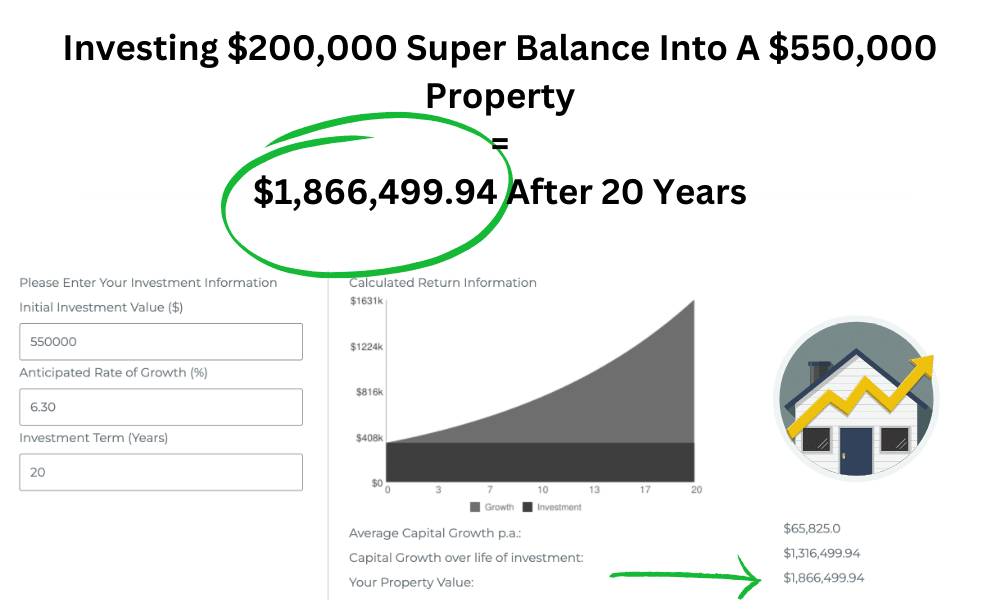

The example below is based on a 47 Year old male earning $140,000 a year and has a current Super Fund Balance of $200,000.

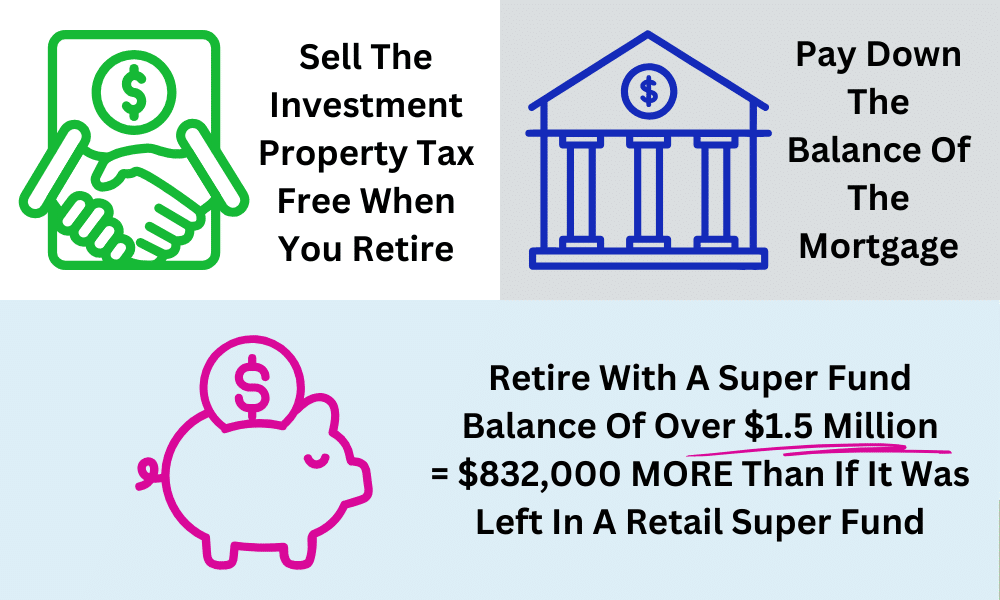

This is what their Super Fund Balance is projected to look like if they left it in a retail Super Fund v if they invested that $200,000 into property

According to the Association of Superannuation Funds of Australia’s Retirement Standard, to have a ‘comfortable’ retirement, a couple who own their own home will need an income of about $67,000 per year. A single person will need an annual income of more than $47,000.

If you choose to retire at 67 and live until 84 (current life expectancy for Australian's) you would require a Super Fund Balance of $1.6 Million for couples or $1.12 million for singles.

Will your current Superannuation investment strategy get you to your goal?

Develop an investment strategy to match your retirement goals

Access to specialist partners for seamless set-up of your Self Managed Super Fund

Identify high-performing & soon to boom locations for faster returns

Qualified Property & Finance Experts Operating Australia Wide

Helping Australian residents boost their super fund balances with the right high growth investment properties.

We match you with one of our qualified property experts to help provide the support you need to avoid some of the most common and costly mistakes when buying an investment property with your Super.

The Investor Accelerator and its experts specialise in finding investment properties in high-growth locations to help investors create wealth, retire early, and enjoy financial freedom faster.

Chat with one of our property experts who can help you pinpoint the right type of property AND location, to complement your investing and retirement goals. If you’re not sure what your goals are yet, they can help you identify them too! They have years of experience and have done the research, so you don’t have to AND so you can get it right the first time around.